On October 20th, the Seattle Department of Transportation released the WSP-conducted Cost–Benefit Analysis (CBA) for the West Seattle High-Rise Bridge Safety Project, and a reader’s guide to the CBA on their blog. The next day, SDOT presented their CBA to the Community Task Force after an introduction on the rapid replacement concept. In their presentation, the agency stated that the CBA only helps to inform and doesn’t make the replace or repair decision.

SDOT is clear that the 89-page CBA is neither a whole nor simple story, as the agency is forced to make assumptions to have this analysis developed within current restraints. For one, the CBA does not quantitatively assess off-alignment bridge replacement alternatives. Assumptions important for urbanists, include Sound Transit having an independent Duwamish Crossing for light rail and the existing 6% approach grades being able to accommodate future light rail.

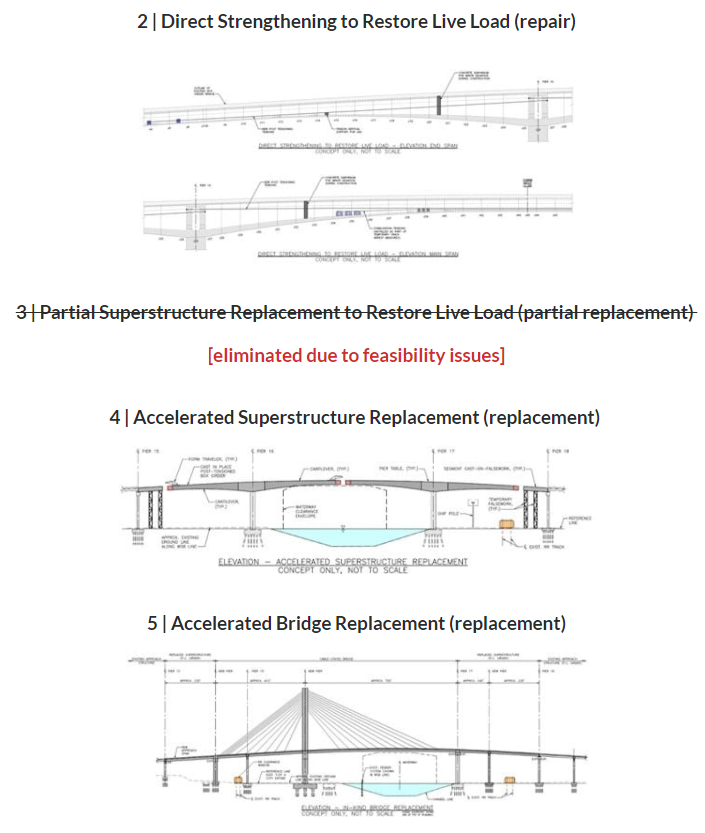

As reported in July, this analysis goes over six options for the West Seattle High-Rise Bridge Safety Project. Options for further evaluation was reduced to five after alternative 3 (partial superstructure replacement) was eliminated due to it being prohibitively difficult. This leaves alternative 2 also known as direct strengthening as the sole repair option. Full superstructure replacement, bridge replacement, and immersed tube tunnel, alternatives 4 through 6 respectively, remain as replacement options. Note that option 1 or shoring is effectively a replacement option as it would only give SDOT five years of lifespan to plan for a replacement.

With theses options, WSP chose archetypes for each option to assign each alternative data points to carryout the analysis. Assignment of archetype for each option won’t affect SDOT’s eventual choice in replace or repair design, but it does give a good idea of how each alternative plays out. For example, the rapid replace option is just another version of alternative 4, but due to its sudden appearance it wasn’t selected by WSP for CBA analysis. SDOT does suspect that rapid replace is of similar cost to other option 4s.

Examining performance

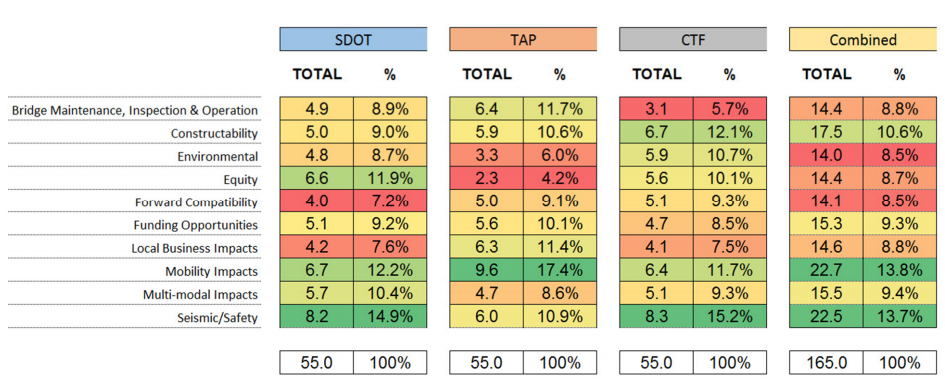

To evaluate the five remaining options WSP had the City, the Technical Advisory Panel (TAP), and Community Task Force (CTF) identify and weigh 10 performance attributes. After those weighted scores were averaged across the three entities, Mobility Impacts and Seismic/Safety came out as the most important criteria that the alternatives were evaluated on. Constructability comes at a distant third. The remain criteria, Bridge Maintenance, Inspection, and Operation, Environmental, Equity, Forward Compatibility, Funding Opportunities, Business and Workplace Impacts, and Multi-modal Impacts, received similar and the least importance according to the combined rating.

Identified and weighted, each performance attribute is broken down into measurable subcategories and each alternative is graded based on each of those measurables. For example, forward compatibility is broken down into future roadway configurations, and light rail accommodation feasibility. Replacement options here are preferred the most and graded the highest, as they could accommodate light rail. See the rest of the performance attributes broken down in Section 3 of the full CBA.

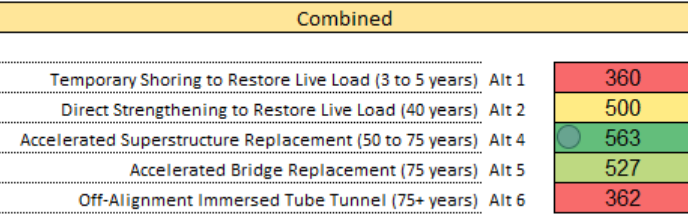

To give ratings, WSP made Alternative 2 the baseline, graded it a 5 on all attributes, and had the other alternatives graded on that anchor–of course making 2 the anchor and default makes the grading exercise illuminate less about Alternative 2 itself. WSP also did not analyze a “No Build” scenario, which is generally a best practice for cost-benefit analyses. With that baseline, experts from SDOT, WAP, and the Technical Advisory Board independently rated each alternative relative to Alternative 2. Once the ratings were averaged, WSP came up with the below chart of ratings and combined performance for the alternatives.

With every alternative rated, alternative 2, 4, and 5 stand out as the most compelling options for performance with each taking top performances in a multiple performance attributes. On the most important issues of mobility impacts and seismic/safety, repair and replace each take one. Even before factoring in the possibility a three-year “rapid replace” timeline in alternative 4’s ratings, superstructure replacement performs the best with full replacement and then repair following close by.

Breaking down the cost data and risk

With benefits quantified, WSP next developed with cost estimates for capital projects costs and life cycle costs. For this early stage, WSP says its rough order of magnitude (ROM) cost estimates have an accuracy of plus or minus 50%.

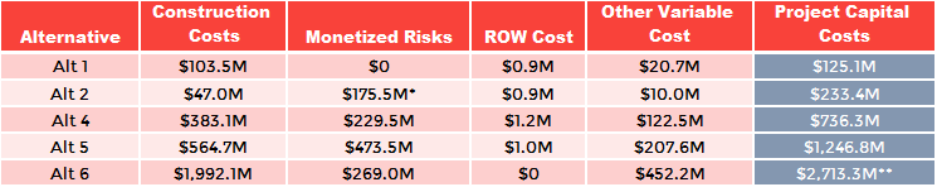

To calculate ROM capital costs, WSP summed up construction costs for initial capital investments, monetized risk, right-of-way, and other variables. These early estimates are intended to capture the full spectrum of potential costs for each alternative, appropriate allowances for easements and property acquisition are included in the costs. With everything factored in, costs come out as one might expect with shoring and repair the cheapest and replace becoming more expensive as the alternatives become more involved.

Risk plays a major fraction in WSP’s ROM cost estimates, they go into detail on risk assessment in section 5 of the cost benefit analysis. There they identify risk, and qualitatively analysis probability, impact, and strategy surrounding a risk to incorporate risk factors into cost. As of now, only 8 of the 40 risk items in the CBA’s registry have been monetized, this list will likely grow once the decision is made. So far, full replacement captures the most risk, and repair carries the biggest fraction of risk as a part of it’s ROM capital costs. For repair, SDOT and WSP are concerned about the success of the repair portion of the bridge and the stabilization of the whole bridge system after repair–both threaten to decrease the 40-year service life of a repaired bridge, which is why SDOT lists a range of 15 to 40 years in its guide. Occurrence probability for both risks are low, but due to the very high impact these risks translate into a significant monetized risk. WSP put the risk of the repair option not making it 40 years at just 5%, but SDOT’s engineers disagree and argue the bridge has failed to perform as expected thus far, causing them to rate a higher risk factor.

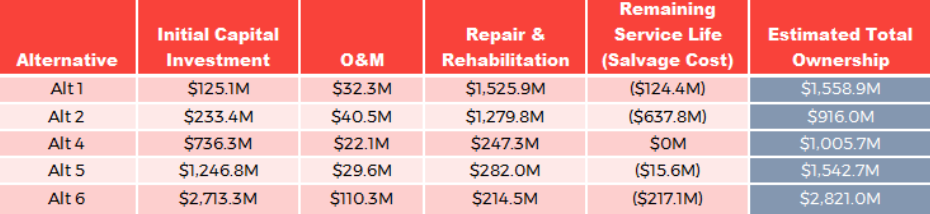

To calculate life cycle costs, WSP first added up ROM capital costs, inspection, operating, and maintenance costs, future repair and rehabilitation costs. Then they subtracted salvage costs, the fraction of capital costs based on remaining years of services at the end of the 2021-2100 life cycle cost assessment. For alternatives 1 and 2, WSP assumes and factors in cost of full replacement at the end of those alternative’s life cycles. That eventual construction cost is factored into the repair and rehabilitation column.

After lifecycle is calculated, repair and full superstructure replacement come out with similar cost estimates, around a billion dollars between 2021-2100, easily within each other’s margins of error. Shoring that will require a full bridge replacement and just a full bridge replacement come out to similar costs, a billion and a half dollars. As expected, the tunnel comes out to the most expensive option with a price tag around $3 billion.

Results and Community feedback

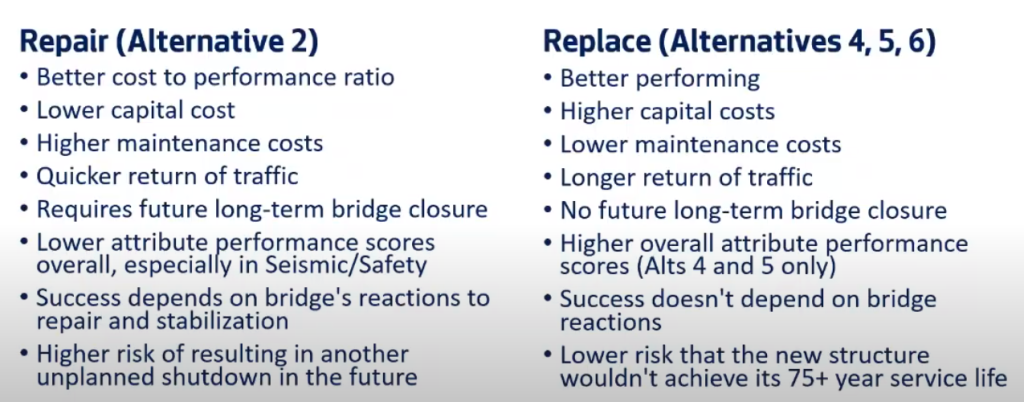

With all the base assumptions, alternative 2 (repair) and alternative 4 (superstructure replacement) emerge as close contenders for best life cycle value. Early on, repair does have better value for the initial capital costs. In its October 21st presentation to the Community Task Force, SDOT does acknowledge that these cost benefit ratios will change as they learn more about the rapid replace option, and more about the state of the bridge during the stabilization process. Positive news either would benefit the outlook on replace or repair, respectively. The agency ends their presentation with the following synopsis on the repair versus replace debate, with positive data for both.

In the final portion of the meeting, SDOT fielded questions and comments from members of the community task force. Some skepticism was shown by a member that thinks that the prohibitive figures assigned to the tunnel were off, citing cheaper and faster figures from other potentially similar tunnels–These claims may have been unfair comparisons. SDOT did not respond to the comment.

Clarity was sought on the seemly low risk of repair and mentioned high risk for repair in the messaging. In response, the agency made clear to separate the two risks for repair, very low for repair failure and another untested risk for the whole bridge failing due to system failure, and compound that risk with the high impact of failure. They also assured that the foundations were in good shape, so they wouldn’t be a risk for alternative 4 and didn’t apply to the bridge system failure risk for alternative 2. Assurances were also given on the seismic safety of the corridor as a whole, noting a resiliency study was still needed for the rest of the corridor.

Limitations and Future Study

As Heather Marx of SDOT remarked, limitations make the analysis behave like a Rorschach test, letting everyone see what they’d like to see. Supporters of repair and replace can take data from this CBA that back their positions. Favorability of repair and replace also shifts depending on the assumptions one can choose to make during this early phase of interrogation. The risk section of the CBA also contains sensitivity studies on the affect of assumptions not made in the base CBA. Those studies give repair the most potential upside.

In section 7 of the CBA, a long and non-exhaustive list of concerns was assembled by WSP with input from the Port of Seattle, Northwest Seaport Alliance, CTF, TAP and City for further exploration and study. That list includes bridge type selection, duration of service life assessment, construction uncertainties, equity impacts, defining marginalized communities, future coordination with Sound Transit, tribal coordination, and formal risk assessment. With these concerns not fully answered, the City will be deciding between repair and replacement in an uncertain environment.

While further study is desired and some West Seattleites demand the option with the quickest reopening of the West Seattle Bridge, city staff are reportedly leaning toward replace with the entertainment of rapid replace. With future compatibility with light rail in mind, The Urbanist has come out in favor of replacement. Follow SDOT’s weekly stabilization updates, bridge announcements and planning, and community outreach event announcements on their blog or the West Seattle Bridge project website.

The featured image is courtesy of Madison Linkenmeyer.

Shaun Kuo is a junior editor at The Urbanist and a recent graduate from the UW Tacoma Master of Arts in Community Planning. He is a urban planner at the Puget Sound Regional Council and a Seattle native that has lived in Wallingford, Northgate, and Lake Forest Park. He enjoys exploring the city by bus and foot.