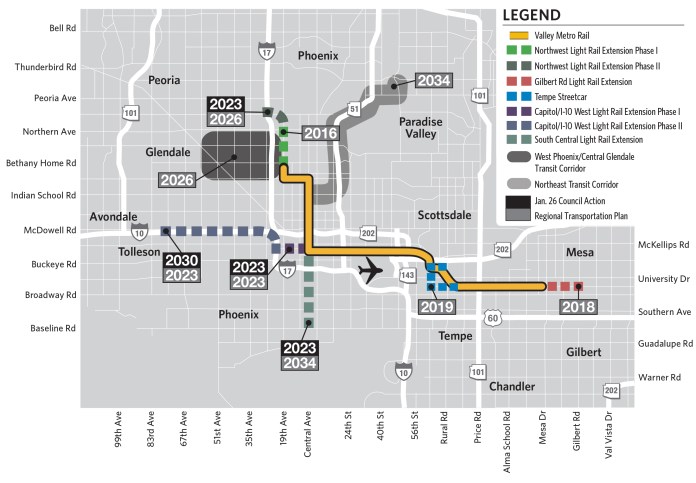

Phoenix, Arizona is about to vote on a ballot measure intended to sabotage light rail expansions. A Valley Metro Rail extension to South Phoenix set to open in 2023 would be the first casualty, but Proposition 105’s ballot language would actually ban new light rail outright, dooming all future expansion efforts. Voters in the City of Phoenix will decide on August 27th.

The measure is backed by conservative billionaire brothers Charles and David Koch through their influential political action committee Americans for Prosperity (AFP). The local anti-transit front group is called Building a Better Phoenix (in true Orwellian fashion) and a Phoenix New Times investigation revealed the campaign’s mastermind Scot Mussi is connected to the Kochs via his employer, the Arizona Free Enterprise Club, an AFP-backed right-wing group. Mussi helped draft the proposal, contracted a signature gathering firm, and regularly advised Building a Better Phoenix members, the investigation showed.

As Laura Bliss reported in CityLab, conservative groups seized on some pushback by local business owners and motorists along the transit route. “It began with a seed of frustration among locals along South Central Avenue, which runs through a working-class section of Phoenix that is predominantly Latino and African-American,” Bliss wrote. “There, Valley Metro Rail planned to remove two traffic lanes to build 5.5 miles of light rail track. Worried that construction and a lack of space for cars would deter customers, a small group of business owners organized last year to demand the transit agency adjust their plans for the South Phoenix area.”

The Koch Empire Is Built on Car Dependence

It’s a playbook that the climate-change-denying Kochs have followed to block transit measures in cities like Nashville and Little Rock. Focus on delays to motorists and the hit to taxpayers, exaggerate the truth, and amplify that message with a huge influx of political spending. The Kochs built their corporate empire on the highway industrial complex. They drill the oil, pipe it, refine it, and sell it to you. Their asphalt builds highways and patches potholes. Coincidentally, conservatives can’t stop talking about potholes as soon as a transit project is proposed. Clearly they have a vested interest in ensuring that everybody drives everywhere and that transit languishes. And that’s why they come out ahead even as they spend millions of dollars on local anti-transit campaigns.

Hasan Minhaj made public transit the topic of his show, The Patriot Act, and highlighted the diabolical stunt the Koch Brothers are trying to pull in Arizona by astroturfing an anti-transit campaign just before Phoenix breaks ground on a light rail expansion.

Minhaj points out that by starving transit of funding, billionaires like the Kochs are trying to make the experience of transit-riding miserable and thereby force you to drive (or at least Uber). If you take climate change seriously, it’s an evil ploy, but it’s working. After a wave of negative ads and press, Nashville’s transit measure went down in flames, despite strong polling early on.

“Unlike Nashville, Little Rock, and other locales where Koch forces have helped [stop] transit projects from getting off the ground, light rail is well underway in Phoenix,” Bliss wrote. “The city’s ballot initiative will now be a test case for whether transit foes can stop a train that’s already left the station.” Valley Metro Rail has been a success story thus far. Its 26-mile route has exceeded expectations pulling in about 50,000 daily riders, and it has fueled a transit-oriented development boom in a region known for suburban sprawl.

“We’ve had more than $10 billion of public and private investment along the light rail line,” said Greg Stanton, the Arizona congressperson and former mayor of Phoenix. “Transit has made us a more urban environment. It gets us closer to our climate goals than anything will. It’s changed Phoenix in ways that nothing else ever has, and support for it has only grown around the Valley.”

Hopefully Phoenix voters are not fooled by Koch propaganda and fearmongering and turn out to the polls August 27th to oppose Proposition 105.

I-976: Is Seattle Next?

It can feel like we are safe in Seattle since transit is popular here. Lately, transit measures have passed by a healthy margins here–the $930 million Move Seattle levy passed with 59% in 2015 and the multi-billion-dollar Sound Transit 3 package passed regionwide with 54% of the vote in 2016. Recent polling has confirmed that public transit support remains strong in King County.

Still, it’s hard to get too confident when conservative political groups are poised to strike at any sign of weakness and billionaires like the Kochs are ready to funnel millions for them to do their worst. Enter Tim Eyman.

Washington state’s own conservative provocateur in Eyman is seeking to pull a Koch-flavored stunt with Initiative 976, which would strip Sound Transit of billions of dollars in car tab revenue and undermine Sound Transit 3 (ST3) and will be on your ballot in November. The Kochs and other oligarchs like them have funded Eyman and propped up his perennial anti-tax ballot amendments and ignored his embezzling of political action committee funds.

Although Sound Transit has taxing authority over only a limited area within the Seattle metropolitan area, Eyman’s I-976 appeals to the whole state of Washington to block Seattle from taxing itself. And since car tabs are an important source of funding for the Washington State Department of Transportation and local transportation departments across the state, I-976 would also throw transportation systems statewide into turmoil. Many cities big and small would suffer cuts.

It’s a really regressive, bad idea, but Washington state voters may be more swayed by anti-tax messaging than by pro-transit messaging. It’s going to be an absolute battle and the stakes are high. One of the biggest complaints about ST3 is that it takes too long to build the transit. I-976 would only add more delays. And climate change is not going to wait while we get it together as a civil society.

Correction: An earlier version incorrectly stated all of Maricopa County would vote on Proposition 105. In fact, only residents of Phoenix will get to vote on the measure. The article has been updated to clarify that point.

Doug Trumm is publisher of The Urbanist. An Urbanist writer since 2015, he dreams of pedestrian streets, bus lanes, and a mass-timber building spree to end our housing crisis. He graduated from the Evans School of Public Policy and Governance at the University of Washington in 2019. He lives in Seattle's Fremont neighborhood and loves to explore the city by foot and by bike.